Towards an energy reset in Venezuela and Guyana

The recent political shifts in Caracas are prompting a fundamental reassessment of South American energy dynamics. As the interim government moves to dismantle decades of resource nationalism, a new regional dynamic is emerging: the stabilization efforts in Venezuela could progressively unlock the country’s potential while providing an immediate and unprecedented "security dividend" for its neighbor, Guyana.

Venezuela’s interim government has passed a law to formally break PDVSA’s monopoly and allow foreign majors to manage oil projects.

Venezuela: breaking the PDVSA monopoly

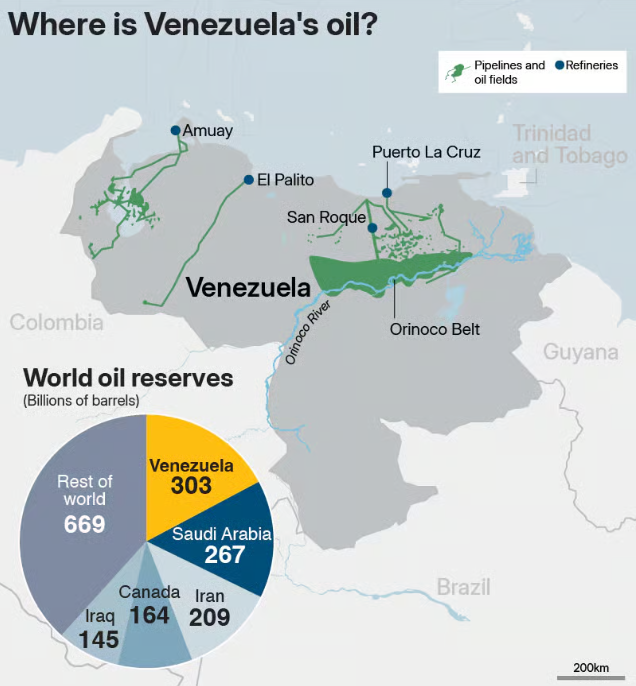

Despite sitting on 300 billion barrels (17% of global reserves), Venezuela’s production has plummeted to less than 1% of world output due to years of neglect. To reverse this, the interim government has fast-tracked a revolutionary reform of the Hydrocarbons Law. The goal is to formally break PDVSA’s monopoly by allowing foreign majors to manage projects at their "own risk and cost."

This is a pragmatic admission that the state can no longer fund the $185 billion investment required to return to historical production levels. By slashing royalties from 30% to as low as 15% and offering international arbitration, Caracas is attempting to make its extra-heavy oil fields competitive again. However, for global investors, legislative change is only the first step; building long-term institutional trust will be a much slower process.

Venezuela currently produces 800,000 barrels per day, far below its historic peak level at 3.5 million barrels per day in the 1990s. Analysts estimate investments worth $110 billion are necessary to reach 2 million barrels per day by 2030. The “reopening” of Venezuela’s oil industry is a long-term challenge. However this process could be facilitated if Washington were to lift current sanctions on the country. This could potentially take Venezuela’s oil production to 1.2 million barrels per day by the end of 2026.

The U.S. interest: beyond geopolitics

Washington’s intervention is driven by a stark industrial necessity: the specialized engineering of U.S. Gulf Coast refineries. These facilities were specifically designed to process the "dense and heavy" crude that defines Venezuelan deposits.

Securing this geographically close supply is a pillar of the current U.S. strategy to lower domestic energy costs. Moreover, the U.S. Southern Command is now actively intercepting "ghost ships" in the Caribbean. This aggressive policing serves a dual purpose: it stabilizes local purchasing power through controlled oil sales and systematically diverts flows away from China, which received in 2025 75% of Venezuela's oil exports. A significant drop in supply should impact Chinese refiners. By forcing a global rival to seek more expensive alternatives, the U.S. is using Venezuelan oil as a tool of economic statecraft.

Guyana: the security dividend

The stabilization of Caracas has an immediate beneficiary: the "Guyanese miracle." With a world-leading 35% annual growth, Guyana’s oil boom has been threatened those past years by Nicolas Maduro’s territorial claims over the Essequibo region.

With the U.S. effectively overseeing the transition in Caracas, this military risk now has largely receded. This newfound "geopolitical certainty" is the ultimate green light for operators like the Exxon-led consortium to push toward their 1.3 million bpd target by 2027. Interestingly, Guyana is using this window of stability to fund an ambitious 80% renewable grid goal by 2040. Through the "Just Energy Transition" (JET) model, Guyana is reinvesting fossil fuel profits into its post-carbon future, a strategy now made safer by the de-escalation of border tensions.

🎯Strategic perspective

The regional outlook for 2026 is defined by a significant de-risking of the South American energy corridor. While Venezuela begins a grueling, decade-long process of physical and institutional repair, Guyana is reaping the rewards of regional stability. For global investors, the stabilization of Caracas could effectively "unlock" the multi-billion dollar offshore potential of the entire Guyana-Suriname basin, allowing the region to consolidate its position as a secure alternative while traditional global supply chains are undergoing major disruptions.